This amount is calculated as follows. Income Tax Malaysia 2019 and 2020.

RM250000 Salary After Tax in Malaysia.

. According to Lembaga Hasil Dalam Negeri LHDNalso known as the Inland Revenue Boardthose earning at least RM34000 a year after EPF deductions need to pay taxesThose who fail to do so can face legal action so make sure you do your part and declare your income. Given the tax rates above you need to remit RM3750 at a rate of 13. RM750000 Salary After Tax in Malaysia.

Before asking how much your salary should be before need ing to pay income tax in Malaysia you should know how tax reliefs work because they can effectively reduce the tax you pay. Do You Need To Pay Income Tax. As a non-resident youre are also not eligible for any tax deductions.

According to the report Statistik Pekerja dan Gaji Upah 2018 by the Department of Statistics Malaysia the average salary and wage for workers in 2017 is RM2804. If taxable you are required to fill in M Form. RM1000000 Salary After Tax in Malaysia.

What is Malaysias personal income tax rate. Tax rates range from 0 to 30. For 2021 tax year.

You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. In 2015 the average salary was RM2594. You can try to compute your taxes using our salary calculator.

A non-resident individual is taxed at a flat rate of 30 on total taxable income. LHDNalso known as the Inland Revenue Boardthose earning at least RM34000 a year after EPF deductions need to pay taxes. For example an employee who is single and earning RM27000 annually would be chargeable to tax if his claim for relief is.

However in this article well be solely focusing on Malaysia Personal Individual Income Tax YA2021 that is tax paid by employees in Malaysia. A person who is chargeable to tax is required to submit an income tax return to the Inland Revenue Board IRB. The following rates are applicable to resident individual taxpayers for YA 2021 and 2022.

Alternatively you can select one of the example salary after tax examples listed below these cover generic salary packages based on annual income in Malaysia. Our calculation assumes your salary is the same for 2020 and 2021. Foreigners with a non-resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will remain the same no matter the amount of income.

Non-resident individuals who earn or receive income in Malaysia are subject to a maximum tax rate of 28 percent on the amount of income earned or received. Chargeability to tax would depend on the amount of income reported and the reliefs and deductions claimed. If the taxpayer wishes to pay tax via Telegraphic Transfer TT Interbank GIRO Transfer IBG or Electronic Fund Transfer EFT they will have to call the HASIL Care Line to receive the payment procedure at 03-8911 1000 call.

This translates to roughly RM2833 per month after EPF deductions or about RM3000 net. In Malaysia an individual earning RM34000 after EPF deduction per annum must pay income tax. However you should still file your taxes even if you earn less than.

Thats a difference of RM1055 in taxes. Taxes for Year of Assessment 2021 should be filed by 30 April 2022. Personal income tax rates.

This income tax calculator makes standard assumptions to provide an estimate of the tax you have to pay for 2021. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file. There was a 40 growth between those two years.

Many Malaysians may find the tax filing process a littlewell taxing but were here to help. Malaysia has a progressive tax system with rates ranging from 0 percent to 28 percent. Taxable Income MYR Tax Rate.

For instance your salary is RM65000. Malaysias personal income tax follows a progressive tax system. Heres our complete guide to filing your income taxes in Malaysia 2022 for the year of assessment YA 2021.

Any individual earning a minimum of RM34000 after EPF deductions must register a tax file. Next RM15000 at 13 tax RM1950. How much tax will be deducted from my salary in Malaysia.

Who should pay taxes. It should be noted that this takes into account all. This would enable you to drop down a tax bracket lower your tax rate to 3 and reduce the amount of taxes you are required to pay from RM1640 to RM585.

Here is a definitive guide to help you both learn and file your personal income tax and corporate income tax. A person who has a taxable monthly income of RM283333 approx must register a tax file. Those who fail to do so can face legal action so make sure.

The mining and quarrying sector recorded the highest average salary and wage of RM10146 in. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with. The system has a wide range of marginal tax brackets across all income levels starting at 1 for employees earning between RM 5000 and RM 20000 and 30 for employees earning above RM 2000000.

However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income would reduce to RM34500. First RM50000 RM1800 tax. For resident taxpayers the personal income tax system in Malaysia is a progressive tax system.

This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. Receiving tax exempt dividends. RM500000 Salary After Tax in Malaysia.

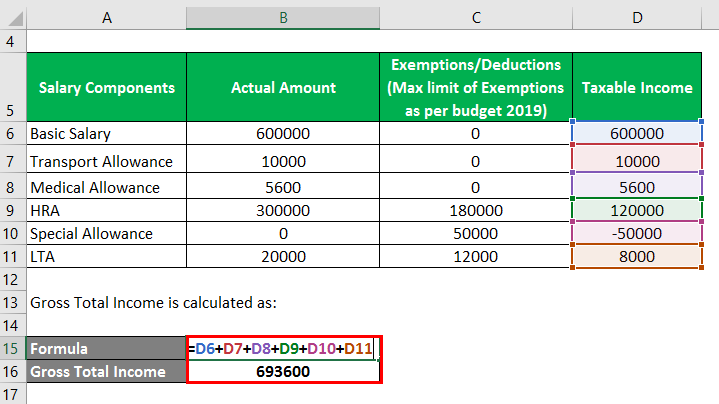

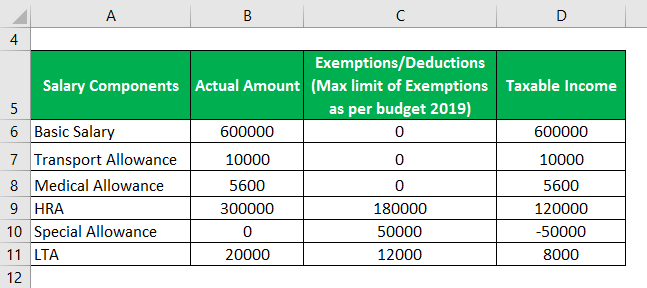

How Is Taxable Income Calculated

What Is Basic Salary Definition Formula Income Tax Exceldatapro

Salary Formula Calculate Salary Calculator Excel Template

Taxable Income Formula Calculator Examples With Excel Template

How To Calculate Income Tax In Excel

Taxable Income Formula Calculator Examples With Excel Template

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Calculator Examples With Excel Template

Taxable Income Formula Examples How To Calculate Taxable Income

Salary Income Perquisites And Allowances Under The Income Tax Act

Cukai Pendapatan How To File Income Tax In Malaysia

How To Calculate Income Tax In Excel

How To Pay Zero Tax For Income Up To Rs 12 Lakh From Salary For Fy 2018 19

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

How To Calculate Income Tax In Excel

How To Calculate Foreigner S Income Tax In China China Admissions

How To Calculate Your 2013 Expatriate Individual Income Tax In China China Briefing News